- List your property - it's free

- Sign up or Log in

-

English- en

-

THB - ฿

- Buy

- Thailand Property For Sale

- Thailand Real Estate

- See Newest Listings

- Why Buy with FazWaz

- Rent

- Sell

- Projects

- Advice

- Property Management

- Vacation Rental Management

You're a real estate investor in Thailand looking to expand your property portfolio, learning how to calculate and utilize cap rates is essential. Cap rates help investors evaluate potential deals and compare investment properties in Thailand.

We are going to dive into how you can use capitalization rate to understanding the profits in your properties or condos in Thailand for 2023 and 2024.

The capitalization rate, or cap rate, is an important metric used by real estate investors to evaluate potential property investments. The cap rate helps assess the risk and potential return of a property.

The capitalization rate (cap rate) is determined by taking the net operating income (NOI) of a property and dividing it by the current market value.

Cap Rate = Net Operating Income / Current Market Value

For example, if a condo in Bangkok generates 300,000 THB in NOI per year and is currently valued at 3 million THB, the cap rate would be:

300,000 THB / 3,000,000 THB = 0.10 = 10% cap rate

Another example by using this condo in Thailand as real world example in 2023. A popular and famous condo in Bangkok, Quintara Mhyzen Phrom Phong condo to buy in Thailand.

It is calculated by dividing the property's annual net operating income (NOI) by the current market value. For example, let's say there is a condo for sale in Bangkok with the following details:

Now I know what you are thinking. How to calculate NOI or what is NOI. NOI is (Net Operating Income) in property investments. We have a full guide on what is NOI and how to calculate NOI for your property investments.

A higher cap rate generally indicates a potentially better return, but also higher risk. Below are key factors that impact cap rates for Thai investment properties:

What to know which location in Thailand provides the best returns on investments. Check out these videos of amazing locations in Thailand for your property investments.

Now you understanding some factors that impact cap rates in Thailand. We are going to delve into what makes a "good" cap rate when investings real estate in Thailand.

There isn't one magic number for a "good" cap rate. It depends on the investor's goals, risk tolerance, and the property specifics. However, here are some general cap rate guidelines:

5-10% - This range is often cited as an ideal cap rate for rental properties. The exact number depends on factors like location and property type.

Higher Cap Rate - Generally indicates higher potential returns but also higher risk. Above 10% can signal issues with the property.

Lower Cap Rate - Typically means lower risk but a longer period to recoup your investment. Below 5% is common for premium markets.

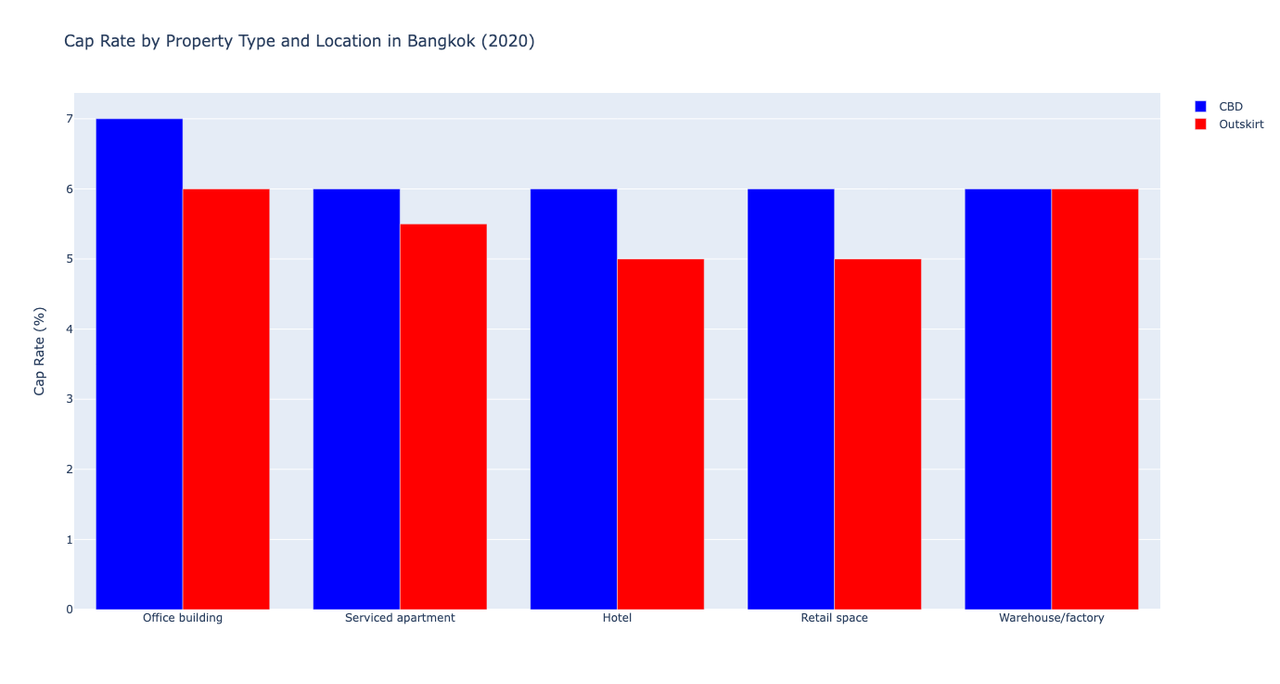

In Thailand since 2022, according to ceicdata a good cap rate in Thailand properties is between 5-8% of your property. Which indicators that it is a normal as worldwide. Another indication that the pandemic did not have a hard hit in real estate industry in Thailand. And how quickly the country property industry investments trends turn upwards.

While cap rate is a helpful metric, don't base your entire investment decision on it alone. Also carefully consider cash flow, appreciation potential, financing terms, and total return on investment for your property investments.

Work closely with real estate professionals to accurately calculate cap rates. Look at cap rates as one tool among many to assess if a rental property is a good addition to your investment portfolio.