- List your property - it's free

- Sign up or Log in

-

English- en

-

THB - ฿

- Buy

- Thailand Property For Sale

- Thailand Real Estate

- See Newest Listings

- Why Buy with FazWaz

- Rent

- Sell

- Projects

- Advice

- Property Management

- Vacation Rental Management

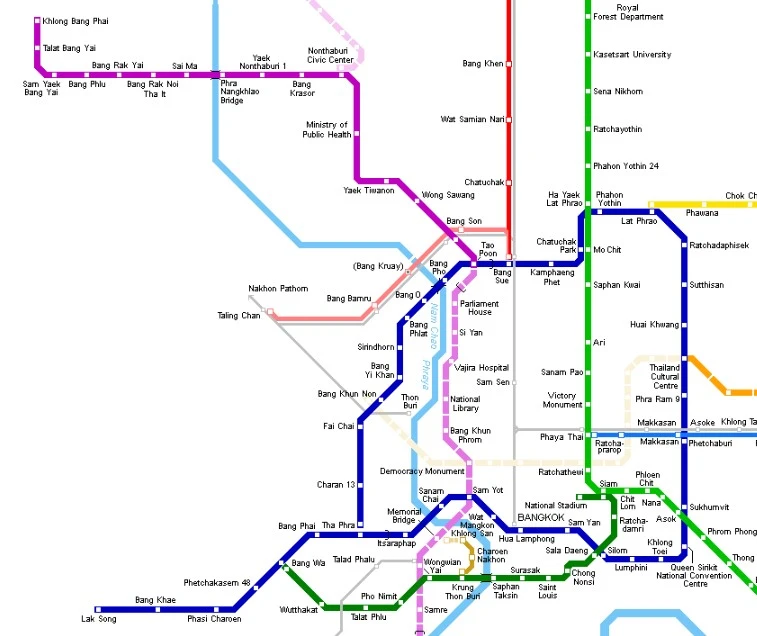

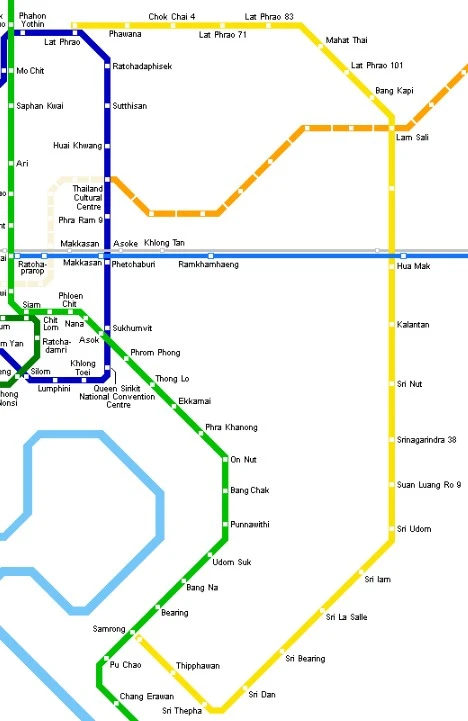

BTS system, also known as the Skytrain, is an elevated rapid transit system that effectively connects various parts of Bangkok. BTS Skytrain provides commuters with a convenient and efficient mode of transportation in Bangkok City. With strategically located stations along different neighborhoods and business districts. BTS stations significantly influence condo prices in Bangkok.

Condos near BTS stations offer you living in Thailand the advantages of convenient transportation and easy access throughout the city. These condos provide a comfortable living space while being near the efficient BTS network. This not only saves you time and money on daily commuting. But also allows you to explore the city effortlessly while minimizing travel expenses.

Particularly for newcomers to Thailand, condos near BTS stations are highly appealing as they offer a stress-free daily commute, free from traffic congestion and long travel times. Living near a BTS station ensures a seamless transition and enables newcomers to navigate the city with ease, facilitating their exploration of Bangkok's vibrant culture and attractions.

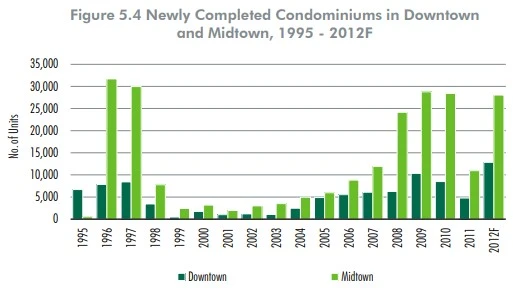

By Q1 2012, the total supply of condos in downtown and midtown areas reached approximately 316,959 units. The downtown area accounted for 30% of the supply (93,593 units), while the midtown area accounted for 70% (223,366 units).

By Q1 2012, the total supply of condos in downtown and midtown areas reached approximately 316,959 units. The downtown area accounted for 30% of the supply (93,593 units), while the midtown area accounted for 70% (223,366 units).

A large percentage of condominiums are located in the Sukhumvit area where important offices and shopping centers are located. Sukhumvit is the most established residential area, supported by the core BTS Sukhumvit Line, with 31% of the condominium supply in the downtown area. The supply in the Silom/Sathorn area, which is supported by BTS Silom Line accounts for 19%. This shows that the most popular condominium locations are along the BTS SkyTrain network.

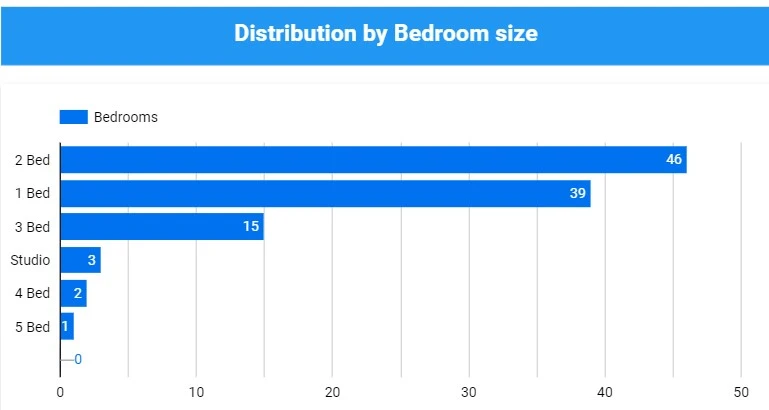

The condominiums situated along the BTS Sukhumvit Line, particularly the area from Siam station to Phra Khanong station, are anticipated to garner significant popularity. These condos primarily belong to the luxury segment and predominantly offer 2-bedroom units. The average price per square meter stands at approximately 93,150 baht, with an average unit price of about 8.77 million baht.

However, it is worth noting that the demand for condos along the Silom BTS route, denoted by the Dark Green line, surpasses that of the Sukhumvit Line. The Silom Line predominantly features mid-range condos with lower average unit prices. Despite not being a central hub location, the appeal of the Sukhumvit Line lies in its close proximity to the BTS stations, coupled with the availability of ample space for new development projects. As a result, the condominiums neighboring the BTS Green Line, regardless of the shade, hold equal popularity in the market.

According to FazWaz's transaction records, the table below shows the sales data for condos situated in close proximity to the Light Green Line or Sukhumvit Line BTS stations. The table highlights the 4 most popular locations as follows:

| Location | 2 Bedroom | Avg. Sales Price | Price per SQM. |

|

Asoke |

14 units | ฿8.94M | ฿137,000 |

|

Phrom Phong |

11 units | ฿15.94M | ฿118,265 |

| 9 units | ฿11.53M | ฿124,000 | |

|

Nana |

6 units | ฿7.91M | ฿67,400 |

*Note: Asoke is in the Khlong Toei Nuea Sub Region, Phrom Phong is in the Khlong Tan Sub Region, Thonglor is in the Phra Khanong Sub Region, and Nana is in the Khlong Toei Nuea Sub Region.

Based on the transaction records obtained from FazWaz, the subsequent table showcases luxury segment condominiums with prices exceeding 30 million baht.

|

Sub Region |

Project Name | Bedroom Types | Sales Price |

|

Khlong Toei Nuea |

The Lakes | 3 | ฿66M |

| Four Seasons Private Residences | 2 | ฿57.6M | |

|

Khlong Toei Nuea |

Prime Mansion Sukhumvit 31 | 2 | ฿52M |

|

Phra Khanong |

Park Court Sukhumvit 77 | 3 | ฿49.9M |

|

Pathumwan |

Sindhorn Residence | 2 | ฿37.47M |

|

Khlong Tan Nuea |

Le Raffine Sukhumvit 39 | 2 | ฿36.5M |

|

Khlong Tan Nuea |

Baan Ananda | 3 | ฿35M |

Upon reviewing the table, it becomes apparent that the majority of luxury segment condos are concentrated in highly sought-after locations, aligning with the information provided in the preceding table. Furthermore, the predominant bedroom type among these condos is 2 bedrooms.

These statistics highlight the varying preferences and motivations of buyers in the Bangkok condominium market, with a range of condominium grades and unit types catering to different needs and aspirations.

Buyers in the real estate market exhibit a preference for newer condominiums over older ones. The allure of newer condos lies in their modern amenities, updated infrastructure, and contemporary designs. The appeal of a fresh, untouched living space resonates with buyers seeking a more modern lifestyle.

Buyers prioritize the benefits and advantages that come with investing in recently constructed properties, leading to a robust demand for newer condos. This is due to their improved energy efficiency, advanced technology, and the sense of convenience and luxury they provide.

In the current real estate market, condominiums located in close proximity to BTS stations emerged as the top preference for buyers interested in Bangkok. While the price of these condos tends to be higher compared to those in less accessible areas. The value of convenient transportation and the abundance of nearby amenities contribute to a fulfilling living experience. Moreover, these properties offer a range of benefits beyond mere accommodation. Furthermore, investing in condos near BTS stations can prove to be financially rewarding, as they often yield favorable returns on investment (ROI).

The table provided below represents our transaction records, shedding light on the prevailing demand for condos situated around BTS stations. The price range encompasses a diverse spectrum, accommodating both affordable options and those falling within the mid-range category.

|

Location |

Types | Bedroom Types | Sales Price |

| Dev Unit | 1 | ฿7.88M | |

|

Sathon |

Dev Unit | 1 | ฿7.5M |

|

Khlong Toei Nuea |

Dev Unit | 1 | ฿5.76M |

|

Phra Khanong |

Dev Unit | Studio | ฿2.56M |

|

Pathumwan |

Off Plan | 1 | ฿17.1M |

|

Khlong Tan Nuea |

Resale | 5 | ฿21M |

|

Khlong Tan Nuea |

Resale | 2 | ฿13.5M |

|

Khlong Tan Nuea |

Resale | 2 | ฿13M |

|

Khlong Tan Nuea |

Resale | 2 | ฿6.5M |

|

Khlong Tan Nuea |

Resale | 2 | ฿5M |

|

Khlong Tan Nuea |

Resale | 1 | ฿4.95M |

|

Khlong Tan Nuea |

Resale | 1 | ฿4.4M |

|

Khlong Tan Nuea |

Resale | 1 | ฿2.26M |

|

Khlong Tan Nuea |

Resale | Studio | ฿1.48M |

In our fast-paced society, time is of great importance. Maximizing our productivity and quality of life hinges on efficient time management. Choosing a residence near a BTS station offers a valuable advantage, as it saves precious time on daily commutes. With convenient access to public transportation, individuals can enjoy more leisure time and have the opportunity to invest it in meaningful pursuits. Therefore, the strategic location of a property near a BTS station should be carefully considered, as it provides a practical solution for optimizing time utilization and enhancing the overall lifestyle.

The impact of the Bangkok Mass Transit System (MRT) on the real estate market in the city cannot be overstated. Since its starting point in 2004, the MRT has already changed the way people live in Bangkok. Resulting in increased demand for properties located in close proximity to MRT stations.

In the MRT's early years, property prices near stations saw significant growth. Condominium prices near the Sukhumvit Line's Petchaburi station surged by 300% from 2004 to 2007. The MRT, an integral part of Bangkok's infrastructure, will continue to drive the city's real estate market.

Below are some key MRT lines in Bangkok:

Properties located near BTS stations experienced significant price appreciation, with some areas witnessing up to a 500% increase in value. Although the rate of price growth has moderated in recent years, properties near BTS stations continue to command a premium due to their convenient location and accessibility.

Rental rates near BTS stations also remain higher compared to other areas, reflecting the desirability of living near efficient transportation options. The BTS Skytrain has attracted foreign investors who recognize the stability and potential for appreciation in properties located within the BTS catchment.

The expansion plans for the Bangkok Skytrain system include the construction of three new lines, each contributing to the enhancement of Bangkok's public transportation network. However, it is important to note that these new lines will not originate from the Midtown area. The upcoming lines are as follows:

The Pink Line: The Pink Line, stretching from MinBuri to Bang Sue, offers convenient transportation for commuters. It will also feature a spur line connecting to Suvarnabhumi Airport, further improving accessibility.

The Pink Line: The Pink Line, stretching from MinBuri to Bang Sue, offers convenient transportation for commuters. It will also feature a spur line connecting to Suvarnabhumi Airport, further improving accessibility.

In recent years, the Bangkok real estate market has witnessed a growing preference for high-rise condominiums near BTS stations. This trend can be attributed to several factors:

1. Land scarcity in prime locations near BTS stations drives developers to maximize vertical space by constructing high-rise buildings.

2. The increasing urban density and population growth in Bangkok make high-rise condominiums an efficient solution to accommodate the rising demand for housing.

3. High-rise developments near BTS stations offer a range of amenities, such as fitness centers and swimming pools, enhancing the quality of life for residents.

4. Proximity to BTS stations provides residents with convenient access to public transportation, meeting the needs of professionals and commuters seeking a hassle-free urban living.

While low-rise developments still cater to specific preferences, the demand for high-rise condominiums near BTS stations remains strong due to the combination of urban density, convenient amenities, and excellent connectivity. This trend reflects the preference of buyers looking to invest in properties near BTS stations. (For MRT visit the article here)

The developer plays a crucial role in buyers' decisions when it comes to investing in condominium projects.

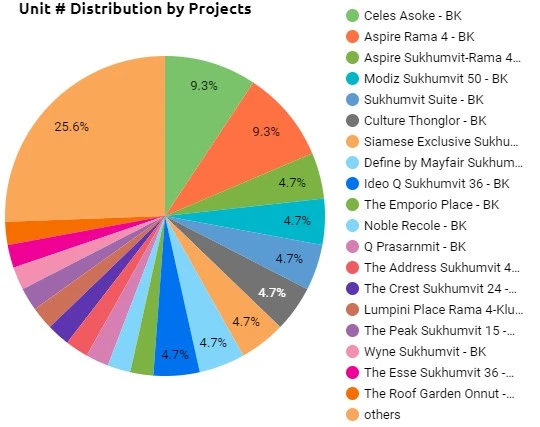

The pie chart offers valuable insights into the factors influencing condominium purchase decisions on a project basis. It is important for developers to know what advantages these popular projects have accordingly to meet the expectations of discerning buyers. By acknowledging and addressing these factors, developers can position their projects strategically to attract and satisfy discerning buyers.

When considering the real estate market in the Sukhumvit region, it's important to note that the top 10 developers in Thailand are highly regarded for their product design and quality. These developers have established a strong reputation for delivering exceptional condominium projects that meet the demands and expectations of buyers. With approximately 90% of these developers being privately owned companies, they have the flexibility and autonomy to focus on delivering high standards of construction, design, and finishing.

The current housing market demonstrates a clear demand for residential properties in high-density areas near business districts like Sukhumvit. Consequently, condominium prices in these areas tend to be higher compared to less crowded locations such as Ratchada. Structural variables, including room size and developer, also contribute to price differentials. However, it is worth noting that these variables hold less significance when compared to factors such as proximity to BTS stations and nearby amenities.