- List your property - it's free

- Sign up or Log in

-

English- en

-

THB - ฿

- Buy

- Thailand Property For Sale

- Thailand Real Estate

- See Newest Listings

- Why Buy with FazWaz

- Rent

- Sell

- Projects

- Advice

- Property Management

- Vacation Rental Management

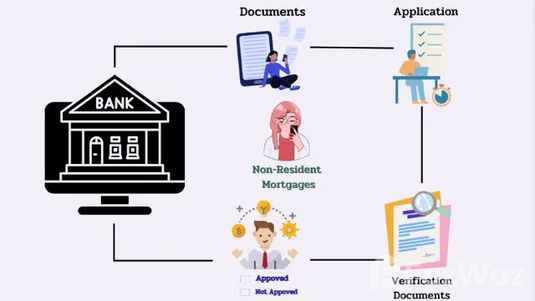

The eligibility and application processes play a crucial role in facilitating non-resident buyer mortgages in Chiang Mai. Understanding and adhering to these processes are of paramount importance for individuals seeking to secure a mortgage as a non-resident buyer. By navigating the eligibility criteria and application procedures effectively, prospective buyers can increase their chances of obtaining a mortgage and fulfilling their property ownership aspirations in Chiang Mai.

When applying for an opportunity or program, it is essential to gather and prepare the required documents to support your application. While the specific documents may vary depending on the program or opportunity you are applying for, here are some commonly requested documents:

It is important to carefully review the application instructions provided by the program or opportunity to determine the specific documents required. Pay attention to any formatting guidelines, deadlines for submission, and whether the documents need to be notarized or translated if applicable. By organizing and preparing these documents in advance, you can ensure a smooth and successful application process.

The application process typically consists of several steps that applicants need to follow to apply for an opportunity or program. While the specific process may vary depending on the program or institution, here are some common steps involved:

The evaluation and selection process for mortgagors seeking a mortgage in Chiang Mai involves several stages that assess their eligibility, financial stability, creditworthiness, and property evaluation. While the exact timeline can vary depending on the institution and circumstances, here is a breakdown of the typical duration for each process:

Overall, the entire evaluation and selection process for mortgagors applying for a mortgage in Chiang Mai can take approximately 9-19 weeks (or 2-4 months) from the initial application submission to the final approval. However, it's important to note that these timelines are estimates and can vary based on individual circumstances, complexity of the application, and the efficiency of the involved parties.

When determining the eligibility requirements for mortgage applicants, several factors are typically taken into consideration. These factors help lending institutions assess the borrower's suitability and ability to fulfill the obligations of the mortgage. Here are some key factors that are commonly considered in eligibility requirements:

It's important to note that the specific eligibility requirements can vary between lending institutions including mortgage programs. It's recommended that borrowers carefully review the eligibility criteria provided by the institution or program they are applying to and ensure they meet the necessary requirements before proceeding with the application process.

Income and employment security play a vital role in determining the eligibility of borrowers for mortgages. Lenders carefully assess these factors to evaluate a borrower's ability to meet their mortgage obligations. Here's a deeper exploration of why income and employment security are crucial for mortgage qualifications:

Understanding the significance of income and employment security is crucial for borrowers seeking mortgage qualifications. Those with stable income sources and secure employment records have a higher likelihood of meeting eligibility requirements and securing favorable loan terms. Maintaining a stable income, showcasing job stability, and providing accurate documentation are key factors for borrowers to enhance their chances of mortgage approval.

In conclusion, having a clear understanding of the eligibility and application processes for non-resident mortgages in Chiang Mai is of utmost importance for individuals who aspire to secure a mortgage as a non-resident buyer. By successfully navigating these processes, prospective buyers can significantly enhance their likelihood of obtaining a mortgage and fulfilling their dreams of owning property in the beautiful city of Chiang Mai.