- List your property - it's free

- Sign up or Log in

-

English- en

-

THB - ฿

- Buy

- Thailand Property For Sale

- Thailand Real Estate

- See Newest Listings

- Why Buy with FazWaz

- Rent

- Sell

- Projects

- Advice

- Property Management

- Vacation Rental Management

Cash-on-Cash (CoC) return calculator compares the cash generated by a property to the cash invested, and is commonly used by seasoned real estate investors. In other words, cash on cash return measures how much money you get to keep for every penny you invest in your property. In our opinion, it is useful to project this figure when you're thinking about making a purchase as well as a metric to monitor over time once you've bought a property. Cash on cash return is one of the most important rental property calculators for assessing the health of your investments because your cash is valuable.

You own a condo in Thailand, a breathtaking country as your new home, or for other investment reasons. You've bought this property with a vision. But how do you evaluate whether it's a sound investment? Using cash on cash returns is one of the main real estate calculations to estimate your profits.

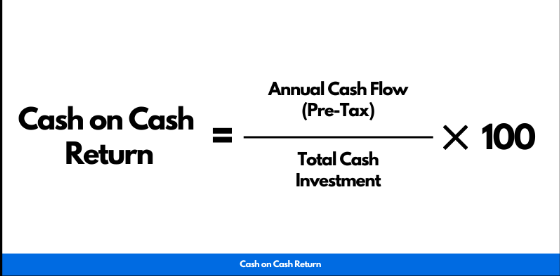

Cash on cash return is calculated by dividing the annual pre-tax cash flow from the investment by the total cash invested. It is a good measure of the short-term profitability of an investment. Cash on cash return is a financial metric that is used to measure the profitability of a real estate investment. It is calculated by dividing the annual pre-tax cash flow from the investment by the total cash invested in the property, and expressing the result as a percentage.

To further understand how this correlates with rental yield, learn how to calculate rental yield outcome here. Stay with us to explore how leveraging this calculation can redefine your investment portfolio.

Real estate investors need to calculate their cash on cash returns to understand how well their investment performed in relation to the amount of cash they invested. Let's explore how to calculate this metric in detail:

Understanding the expenses needed to calculate cash on cash returns is vital. Key variables include:

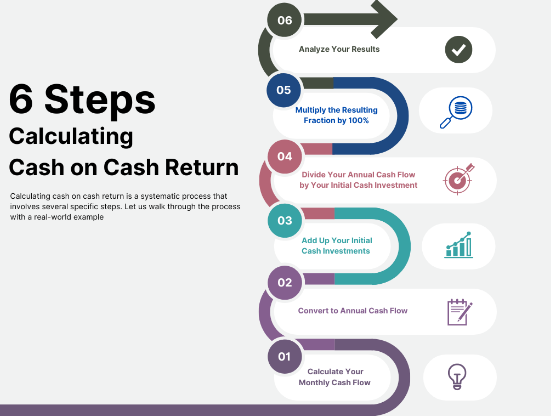

Calculating cash on cash return is a systematic process that involves several specific steps. Let us walk through the process with a real-world example:

Calculate Your Monthly Cash Flow: Begin by considering all sources of income, such as rent, pet deposits, or additional fees, and subtracting your total expenses, which may include mortgage payments. Suppose you earn $2,000 (฿67,580) per month in rent and pay $1,600 (฿54,064) in expenses, leaving a net cash flow of $400 (฿13,516) each month.

Convert to Annual Cash Flow: Multiply your monthly cash flow by 12 to determine the annual cash flow. Using the example above, your annual cash flow would be $4,800 (฿162,960) ($400 per month x 12 months).

Add Up Your Initial Cash Investments: Include all the cash expenditures you made when acquiring the property, such as the down payment, closing costs, and necessary repairs or improvements. Assume you purchased a rental property for $250,000 (฿8,447,500), made a 25% down payment of $62,500 (฿2,115,625), incurred $7,000 (฿236,930) in closing costs, and spent $3,500 (฿118,465) on initial repairs. Your total initial cash outlay would be $73,000 (฿2,471,020).

Divide Your Annual Cash Flow by Your Initial Cash Investment: This step involves dividing your annual cash flow by your initial cash investment to calculate the cash on cash return. From our example, you would divide $4,800 (฿162,960) by $73,000 (฿2,471,020), resulting in approximately 0.0658.

Cash on cash calculation is for you who are looking into real estate as investments purposes. As a condo owner, it's important to anticipate that the rental income will exceed the mortgage payments, ensuring consistent monthly returns. This strategy enables ownership of high-value condominium assets with a relatively modest initial investment. This approach holds significant weight in assessing both present and future investment returns, especially in the context of purchasing a condo for sale in Thailand.

Down below are few reasons on how understanding to use cash on cash formula is important for your property investment journey.

A good cash-on-cash return varies depending on the country. As it is influenced by factors such as interest rates, economic stability, regulatory environment, and local real estate market dynamics.

Determining a "good" cash-on-cash return in real estate investment is a nuanced concept. It factors into your own investment strategies.

Down below we have a few examples on how to calculate a good cash on cash returns for properties in Thailand.

Phuket House: Banyan Tree Grand Residence (125M baht)

- Assuming a monthly net cash flow of 500,000 baht (after expenses):

- Annual Cash Flow: 500,000 baht * 12 months = 6,000,000 baht

- Annual Cash Flow: 500,000 baht * 12 months = 6,000,000 baht

- Cash on Cash Return: (6,000,000 / 125,000,000) * 100% = 4.8%

Bangkok Condo: The Lakes (66M baht)

- Assuming a monthly net cash flow of 300,000 baht (after expenses):

- Annual Cash Flow: 300,000 baht * 12 months = 3,600,000 baht

- Initial Cash Investment: 66M baht

- Cash on Cash Return: (3,600,000 / 66,000,000) * 100% = 5.45%

From this comparison, Bangkok condo offers slightly higher cash on cash return at 5.45% compared to the Phuket House at 4.8%. For those in the exploratory stage, undecided on whether to invest in a house or a condo, recognizing the nuances between these property types becomes paramount. Delving into the distinctive merits and considerations of houses and condos offers valuable insights that resonate with your investment aspirations and lifestyle inclinations. Learn more about the differences between a house and a condo to make an informed decision that best suits your needs.

Cash-on-cash return serves as a critical instrument, in orchestrating the down payment on a property. This metric explains the prompt returns relative to the investment, enabling investors to formulate discerning strategies for impending acquisitions.

How Cash on Cash Helps with Down Payment:

You are considering real estate investment for rental income, employing the Cash-on-Cash Return formula stands out as the most reliable and pragmatic approach. This method comprehensively factors in nearly all investment variables, including money, installments, down payments, and more. Whether you're making an investment decision or receiving investment proposals, it's advisable to utilize this formula to determine the most favorable course of action.