- List your property - it's free

- Sign up or Log in

-

English- en

-

THB - ฿

- Buy

- Thailand Property For Sale

- Thailand Real Estate

- See Newest Listings

- Why Buy with FazWaz

- Rent

- Sell

- Projects

- Advice

- Property Management

- Vacation Rental Management

When buying a new house, two things often come to mind: interest rate and home price. The home price is the total cost of the house, while the interest rate is the amount charged to take out a mortgage. Both factors are crucial in determining whether it's a good time to buy and what type of home you can afford.

However, the question remains: which factor matters more? In this article, we'll explore the relationship between interest rates and home prices and provide some insights for those in the market for a new home.

It's safe to say that interest rates do have an impact on home prices, with an inverse relationship often existing between the two. If the Federal Reserve raises interest rates, the affordability of expensive homes decreases, causing prices to fall. Conversely, if mortgage rates are low, buyers have more purchasing power, and home prices will start to increase. However, it's important to note that this relationship is not set in stone, as the market is constantly changing.

In recent years, we've seen historically low interest rates, while housing prices have reached an all-time high.

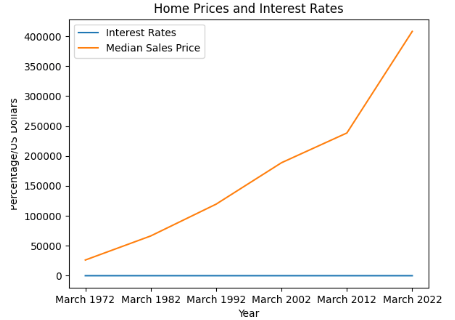

COVID-19 caused interest rates to drop to record lows, which may make people and homebuyers nervous about rising mortgage rates. However, when you look at interest rates from a historical perspective, you can see that rates are still low in comparison. The following chart provides an overview of mortgage rates and median sales prices of homes each March since 1972, based on data from Freddie Mac, the Census, and the Department of Housing and Urban Development.

As homebuyers, the decisions you make regarding interest rates and home prices have a significant impact on your buying journey. Especially if you're a first-time homebuyer.

In this section, we'll take a closer look at how these two factors affect you and what you should consider before taking action in the market. The two main factors are: Down Payment and Monthly Payment.

Down payment for your home is a significant factor in your journey when you are buying a home. Standard practice in the real estate industry is to make a 20% down payment to avoid private mortgage insurance. But as home prices rise, many required down payment increases. Which in results makes it challenging for first-time buyers to enter the market.

While some lenders may accept a lower down payment, keep in mind that it often comes with a higher interest rate. This means that if you can't make a 20% down payment, you'll end up paying more in interest over the life of your mortgage.

Monthly mortgage payment the second most important factor to consider in your buying journey in becoming a home owner. The amount you pay each month is determined by the home price, your down payment, and the interest rate. Therefore, buying a more expensive house will lead to a higher monthly payment, and a higher interest rate will cause it to go up even more.

It's important to calculate your monthly mortgage payment and make sure it fits comfortably within your budget. Keep in mind that your monthly payment also includes property taxes, insurance, and any homeowner association fees.

Ultimately, as a homebuyer, it's important to do your research and ensure that the market conditions are right for you. Understanding how interest rates and house prices impact your down payment and monthly payment will help you make informed decisions and avoid costly mistakes.

Now let's provide you homebuyers with some examples to make a decision of home price vs interest rates. More importantly what matters more, when you are in the process of buying real estate.

Here's a scenario for you homebuyers to consider: Let's say you opt for a lower interest rate and a higher home price. By doing so, you can afford to purchase a bigger house. Which you believe will appreciate in value over time.

For example, you're interested in buying a piece of real estate in Thailand. You find a beautiful home for 12,000,000 Thai Baht (approximately $373,431 USD) and put down a 10% down payment of 1,200,000 Thai Baht (approximately $37,343 USD). Your loan term is 30 years and your interest rate is 3.25%. Not including insurance and taxes, your monthly payment will be 39,182 Thai Baht (approximately $1,219 USD). Yearly your payment with interest rates is 470,184 Thai Baht.

Keep in mind that a lower interest rate can help you save money over the long run, as you'll be paying less interest on your mortgage. If you plan to stay in your home for a while, a bigger house can provide more space for your family to grow and enjoy. However, it's important to remember that a higher home price may also mean a larger down payment and higher monthly payments, so be sure to consider all of your options carefully before making a decision.

For homebuyers or real estate investors looking to save on monthly mortgage payments, prioritizing a lower house price can be a smart move. Let's say you find a great property in Thailand called 'The Jasmine' with a price tag of ฿9,000,000 (around $275,000).

Assuming you put down a 10% down payment and get a 30-year loan term with a 3.25% interest rate, your monthly mortgage payment would be around ฿31,341 (around $955). This is considerably lower than the previous scenario, where the monthly mortgage payment was over $1,175.

By buying a lower-priced home like 'The Jasmine', you can build equity faster and potentially refinance more easily in the future. Keep in mind that lower prices may come as a result of higher interest rates, so it's important to do your research and run the numbers yourself based on what's happening in the local real estate market.

Relationships between interest rates and home prices is crucial for anyone considering buying or selling a home. Low interest rates make homes more affordable, but they can also lead to higher home prices. High interest rates can lower home prices, but they can also make homes less affordable. By examining various scenarios and examples, we can see how interest rates and home prices interact and how they can impact our decisions as homebuyers or sellers. It's essential to keep track of interest rates and home prices and to make informed decisions based on the latest trends and data in your homebuyer journey.

Contact FazWaz today to schedule a viewing of one of our available homes. Our experienced real estate agents can help you navigate the complex world of interest rates and home prices and find a property that meets your needs and budget. Don't wait any longer to find your dream home – schedule a viewing now!