- List your property - it's free

- Sign up or Log in

-

English- en

-

THB - ฿

- Buy

- Thailand Property For Sale

- Thailand Real Estate

- See Newest Listings

- Why Buy with FazWaz

- Rent

- Sell

- Projects

- Advice

- Property Management

- Vacation Rental Management

Embarking on your home buying journey? Prepare to face the 'Rent vs Buy' conundrum squarely. It's a delicate equilibrium between the freedom of renting and the enduring benefits of owning a home. Whether you're considering purchasing a house or a condo, each option has its distinct advantages and disadvantages. Whether you're thinking about starting a family, just finished college, or looking into investment properties, the best choice should always align with your personal circumstances and ambitions. Let this article serve as your guide, helping to clear the uncertainty and providing a thorough roadmap as you navigate the 'Rent vs Buy' decision.

The decision to rent or buy a home is a significant one, with each option presenting its own set of unique advantages and challenges. As you embark on this monumental home buying journey, it's crucial to understand the pros and cons of both renting and buying. Let's delve into the important details of the rent vs buy debate to help guide you in making this essential life choice.

| Buying Pros | Buying Cons |

| Potential for equity building, accessible via home equity products. | Substantial upfront costs and paperwork. |

| Independence from landlords. | Potential loss if home values drop. |

| Enhanced stability, particularly regarding school zones. | Additional expenses beyond mortgage payments. |

| Potential tax benefits. | Challenging market conditions: rising home prices and low inventory. |

| Freedom to customize and upgrade your home. | Responsibility for repairs and remodeling. |

| Renting Pros | Renting Cons |

| Lower upfront costs and less paperwork. | Risk of rent increases. |

| Greater mobility and flexibility. | Possibility of forced relocation if the landlord sells. |

| No responsibility for maintenance or repairs. | Contributes to the landlord's equity, not yours. |

| Protection against falling home values. | Limited vacancies in competitive rental markets. |

| Credit building (if rent payments are reported to credit bureaus). | Absence of tax benefits. |

| No property tax bills. | Limited freedom in design and customization. |

The rent vs buy debate, especially in the context of condominiums in Thailand, primarily depends on individual situations and financial strength. Home buying, like purchasing a luxury condo in Bangkok's Sukhumvit area, allows you to invest in a property that appreciates over time, offers the liberty to personalize your space, and presents the possibility of profit from the increase in property value. However, it involves a significant upfront cost and the duty of maintenance.

On the other hand, renting, such as a beachfront condo in Phuket, provides flexibility, making it an attractive option for those with a temporary lifestyle or those unable to shoulder the large initial investment of buying a condo. While renting relieves you of property maintenance responsibility, it doesn't yield any return on investment like buying does. Therefore, the rent vs buy decision should take into account personal requirements, financial preparedness, and future plans.

When selecting a new home, the decision between a condo and a house holds immense significance as it directly influences your lifestyle. Each option presents distinct advantages and factors to consider. Let's delve into the disparities between condo and house projects. We will explore aspects such as ownership structure, amenities, privacy, and community to equip you with the knowledge necessary to make an informed decision when choosing your new home.

| The Key difference | Condo Project | House Project |

| Ownership Structure | You own an individual unit within a larger building or community. | You own the entire property, including the land and the structure. |

| Maintenance and Responsibilities | Exterior maintenance and repairs are typically handled by the homeowners' association (HOA), while you're responsible for the interior of your unit. | You're solely responsible for all maintenance tasks, both inside and outside the property. |

| Amenities and Facilities | Condos often offer shared amenities like swimming pools, fitness centers, and communal spaces. | Houses typically have fewer shared amenities, but you have the freedom to add private amenities to your property. |

| Privacy and Space | Condos involve sharing walls, floors, and ceilings with neighbors, with possible soundproofing measures. Suitable for individuals or small families. | Houses provide more privacy and space as standalone structures with dedicated yards or gardens. Suitable for larger families or those seeking a quieter living environment. |

| Community and Lifestyle | Condo communities foster a sense of camaraderie and offer opportunities for social interactions and community events. | Houses offer more autonomy and independence, allowing you to establish your own rules and routines without HOA regulations. |

Please note that this revised table provides a concise overview of the key differences between condo and house projects. For a more comprehensive understanding, consider consulting the "Condo vs House Trends in Thailand Guide". This guide can illuminate how additional details and considerations may vary depending on specific projects and locations.

The optimal time for home buying, autumn and early winter, especially October, stand out. During this month, buyers often secure real estate deals with premiums averaging 3.3% above the median home value. November and December follow closely, with premiums around 3.7%. The most favorable purchase days are during the fourth quarter for the year. and into the New Year, such as Nov. 28 (1.1% premium), Jan. 9 (1.3%), Dec. 5 and 26 (1.5%), and Dec. 19 (1.9%).

On the other hand, May is the least favorable month to buy a home, commanding a 10.5% premium over market value, particularly on the 20th, 23rd, and 27th, when premiums surpass 15%.

For those considering renting a home, late fall and winter months, from October to February, often prove beneficial. Decreased demand during this time can offer renters a wider selection of properties and potential negotiation opportunities for lower rents. However, these patterns can vary based on location and market conditions, so continuous monitoring of the rental market and considering personal circumstances is crucial when determining the best time to rent.

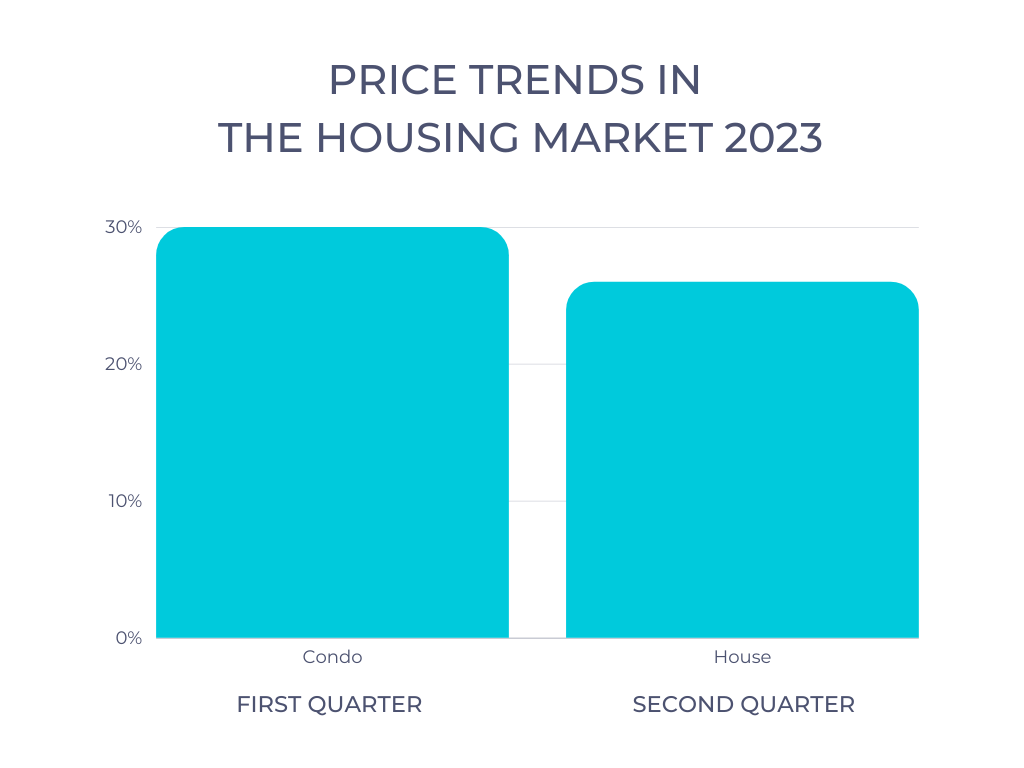

Price trends in the housing market can fluctuate significantly over time and between property types. In the first quarter of 2023, 30% of homebuyers secured condos at a price 5.2% lower than the listing price. However, in the second quarter of 2023, 26% of buyers paid an extra 18% above the listed price for house projects. This variation underscores the dynamic nature of property pricing.

Thailand has experienced a decrease in inventory due to interest rate increases, impacting home affordability and leading to fewer properties available for sale. As a result, the market has become more competitive for buyers, with limited options. Potential homebuyers should be prepared to act quickly and make competitive offers to secure a property in the current market conditions.

Conclusively, the decision to buy or rent a home is monumental, and selecting the perfect platform to facilitate this is crucial. Fawaz.com, a reliable and user-oriented platform, simplifies the home buying process and offers a multitude of options, customized to your specific requirements. It's time to decide, rent or buy? The choice is yours, but remember, a dream home is waiting for you at Fawaz.com. Don't hesitate! Act now, visit Fawaz.com and dive into a smooth, effortless journey of home buying. Your ideal home is just a click away. Act today, and transform the concept of 'home' from a dream to a reality.